Interest income formula

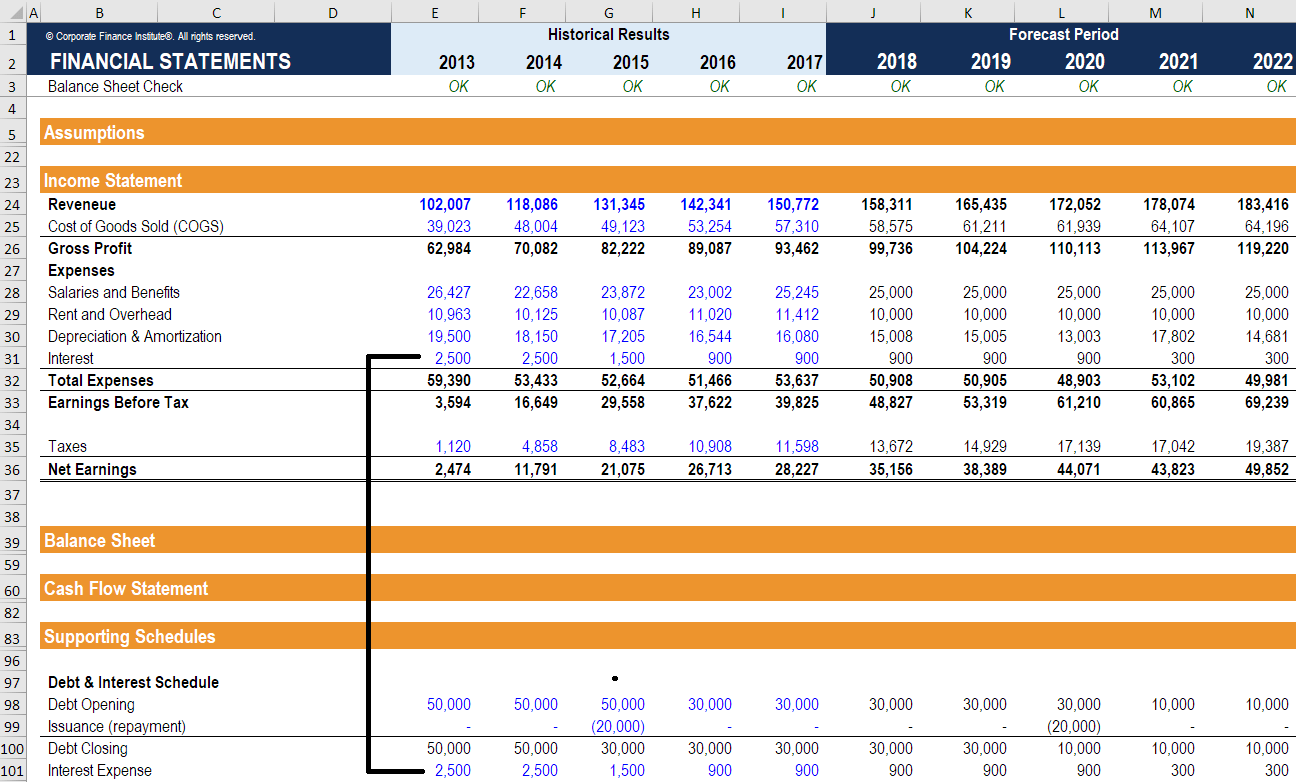

Operating Income Formula Calculator. Absorption Costing Formula Table of Contents.

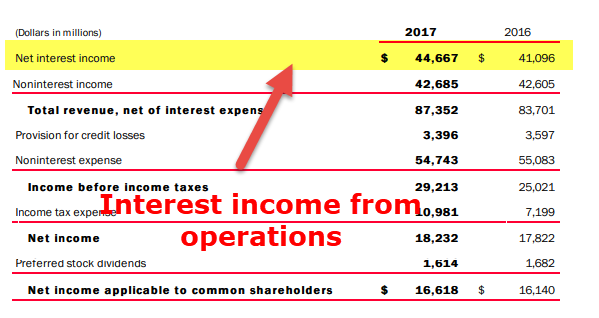

Net Interest Income Overview And How To Calculate It

Jefferson earned the annual interest rate of 481 which is not a bad rate of return.

. Relevance and Use of Accrued Interest Formula. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Real Interest Rate Formula Table of Contents Formula.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Net income includes the amount of funds remains after all operating expenses taxes interest and preferred stock dividends being deducted from the companys total revenue. Total Revenues Total Expenses Net Income.

EBIT is net income before interest and income taxes are deducted. Net tax paid on the Earnings before tax EBT amount and escapes the capitalization impact. Or if you really want to simplify things you can express the net income formula as.

It may be seen as an implication of the later-developed concept of time preference. In management accounting absorption costing is a tool which is used to expense all costs which are linked with the manufacturing of any product. Operating income is a companys gross income less operating expenses and other business-related expenses such as SGA and.

It is also known as operating profit or earnings before interest and taxes EBIT. And the interest is payable in the frequency which is monthly and the rate of interest calculated is calculated based on daily. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate.

Operating income youre probably wondering how you can easily calculate your businesss net income. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. The formula is given below.

Under the single-step method the formula for income statement calculation is done by using the following steps. Now that youve learned about net vs. Compound Interest Explanation.

The compound interest formula is the way that compound interest is determined. Operating income is a measure of profitability that is generated from operations. The term real interest rate refers to the interest rate that has been adjusted by removing the effect of inflation from the nominal interest rateIn other words it is effectively the actual cost of debt for the borrower or actual yield for the lender.

If you have 100 and the simple interest rate is 10 for two years you will have 102100 20 as interest. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. Find out the initial principal amount that is required to be invested.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Operating income is sales revenue minus operational direct and indirect cost. You can quickly determine your net income by using this simple formula.

A creditor has extracted the following data from the income statement of PQR and requests you to compute and explain the times interest earned ratio for him. Typically the richest of the rich pay 40 percent tax on their. Those terms have formal legal definitions in.

In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. To compute compound interest we need to follow the below steps. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later.

10481 1 r. Now you can plug both numbers into the net income formula. EBITDA stands for earnings before interest taxes depreciation and amortization.

Net Income Total Revenues Total Expenses. It is computed as the residual of all revenues and gains less all expenses and losses for the period. Compound interest is valuable for those who make deposits because it is an additional income for them the longer the deposit sits without withdrawals.

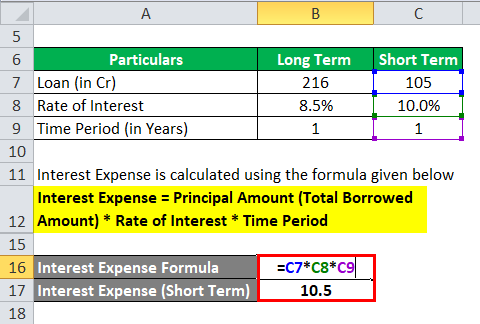

Interest expense in this context simply equals the amount of money borrowed times the stated interest rate. The Net Income Formula Explained. Next determine the non-operating items such as interest income one-time settlements etc.

Carried interest is a loophole in the United States tax code that has stood out for its egregious unfairness and stunning longevity. Finally the net income calculation is done by adding the net of non-operating items non-operating income non-operating expense. Gross profit and net income should not be used interchangeably.

EBITDA is one indicator of a companys. You can deduct investment interest expense against any investment income -- but only if. 20000 net income 1000 of interest expense 21000 operating net income.

In the first quarter your bakery had a net income of 32000. It is valuable to lenders because it represents additional income earned on money lent. EBIT 1 Tax Rate.

What is the Real Interest Rate Formula. 11 A taxpayer cannot deduct the cost of a capital expenditure in computing income from a business or property. This will give you 43000.

In simple interest you earn interest on the same principal for the investment term and you lose out on income that you can earn on that additional amount. EBITDA - Earnings Before Interest Taxes Depreciation and Amortization. The net debt to earnings before interest depreciation and amortization EBITDA ratio is a measurement of leverage calculated as a companys interest-bearing.

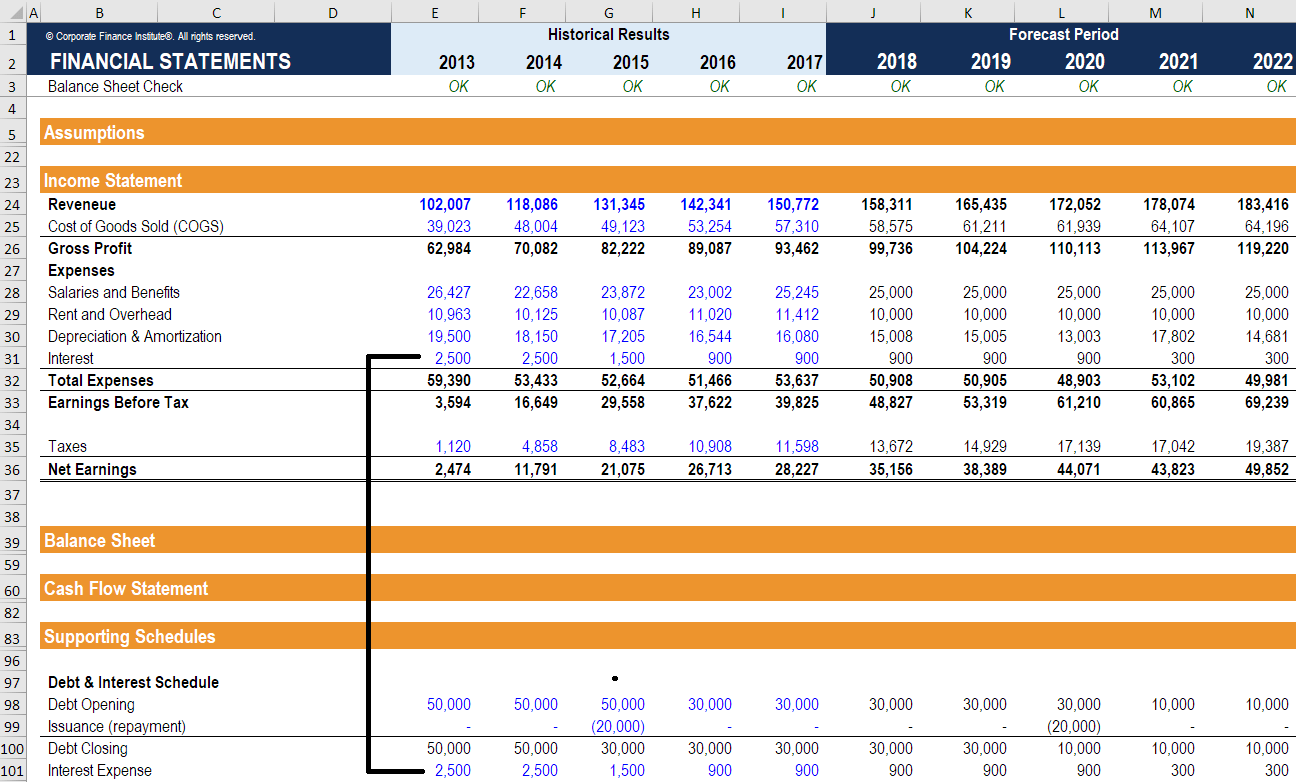

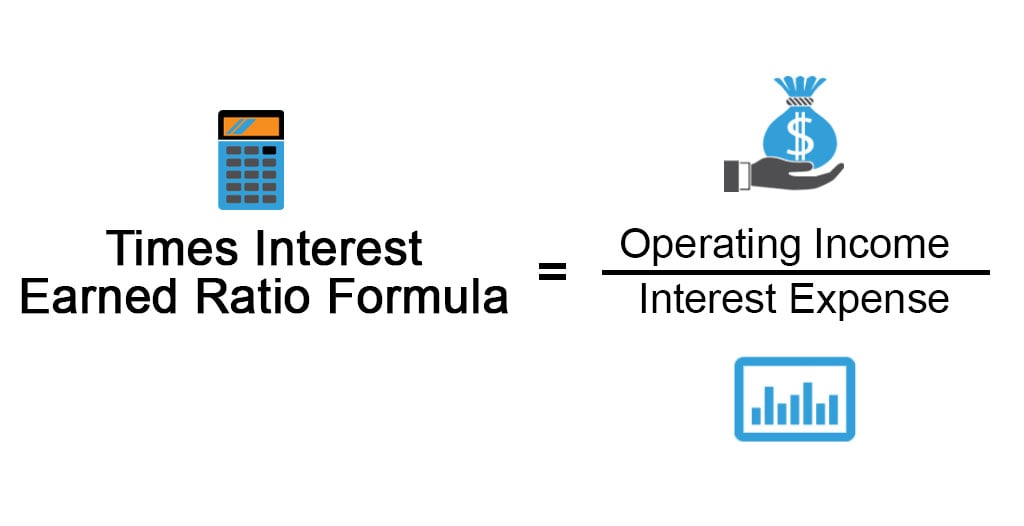

Income before interest and tax ie net operating income and interest expense figures are available from the income statement. This is because paragraph 181b prohibits the deduction of any outlay loss or replacement of capital payment on account of capital or any allowance for depreciation obsolescence or depletion unless specifically allowed in Part I of. An MMM-Recommended Bonus as of August 2021.

Net Debt To EBITDA Ratio. Gross income and net vs. Calculating net income and operating net income is easy if you have good bookkeeping.

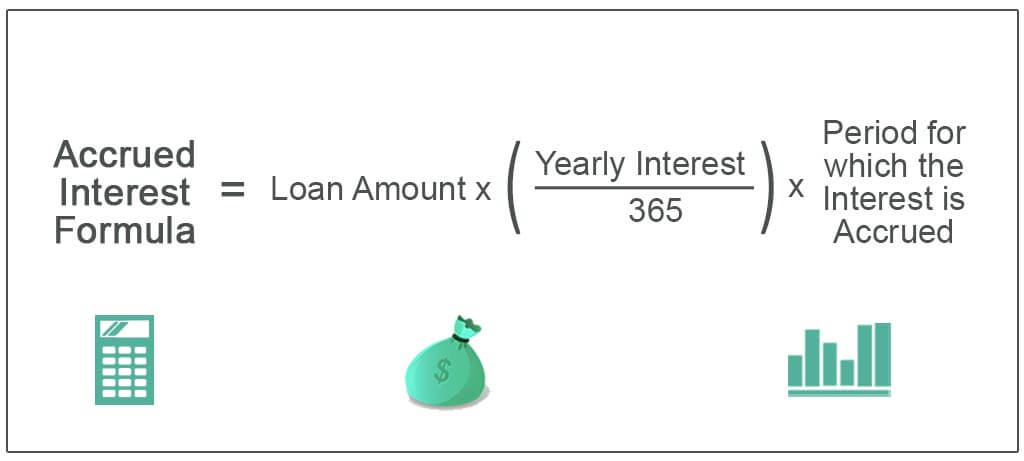

Net income total revenue 75000 total expenses 43000 Net income 32000. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. The basis of accrued interest is based on accrual-based accounting.

The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing. Examples of Absorption Costing Formula With Excel Template Absorption Costing Formula. So the yearly interest rate for the amount invested in the monthly income scheme is around 8.

In that case you likely already have a.

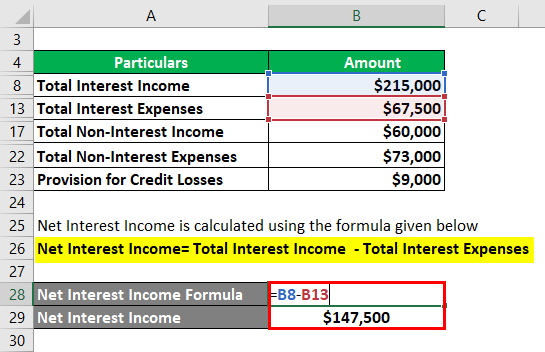

Net Interest Income Nii Formula And Calculator Excel Template

Net Interest Income Financial Edge

Interest Expense How To Calculate Interest With An Example

Accrued Interest What It Is And How It S Calculated

Times Interest Earned Ratio Formula Examples With Excel Template

Net Interest Margin Meaning Formula How To Calculate Nim

Interest Expense Formula How To Calculate

Interest Income Formula And Calculator Excel Template

Times Interest Earned Ratio Meaning Formula Calculate

Interest Coverage Ratio Formula And Calculator Excel Template

Interest Income Definition Example How To Account

Bank Efficiency Ratio Formula Examples With Excel Template

Times Interest Earned Ratio Formula Examples With Excel Template

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest

Interest Income Formula And Calculator Excel Template

Net Interest Income Nii Formula And Calculator Excel Template

Interest Expense Formula Calculator Excel Template